sales tax oklahoma tulsa ok

The Oklahoma sales tax rate is currently. Inside the City limits of Tulsa the.

The Fiscally Responsible Way To Reduce Taxes On Groceries Oklahoma Policy Institute

Oklahoma has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 65.

. Sales Tax in Tulsa. How much is tax by the dollar in Tulsa Oklahoma. The December 2020 total local sales tax rate was also 8517.

The Tulsa County Treasurers Office holds a real estate auction each year on the second Monday of June and continues from day to day thereafter until said sale has been completed. The Tulsa County sales tax rate is. The 2018 United States Supreme Court decision in South Dakota v.

There is no applicable special tax. Tulsa OK Sales Tax Rate. The County sales tax rate is.

7288 TULSA CTY 0367 7388 WAGONER CTY 130 7488 6610 WASHINGTON CTY 0409 1 7588 WASHITA CTY 2 7688 WOODS CTY 050 7788 WOODWARD CTY 090 Rates and Codes for. Tulsa County 0367. The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa County sales tax and 365 Tulsa tax.

What is the sales tax rate in Tulsa OK. Oklahoma City OK Sales Tax Rate. Estimated Combined Tax Rate 852 Estimated.

Oklahoma for sale on Zillow. Ponca City OK Sales Tax Rate. The minimum combined 2022 sales tax rate for Tulsa Oklahoma is.

This is the total of state and county sales tax rates. City 365. The current total local sales tax rate in Tulsa OK is 8517.

Owasso OK Sales Tax Rate. Cities and counties tack on as much as six and a half cents more. The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877.

The average local rate is 443. The Tulsa sales tax rate is. Some local sales taxes are for general purposes and some are dedicated or earmarked for specific.

The Oklahoma OK state sales tax rate is currently 45 ranking 36th-highest in the US. 1 day agoHome in Tulsa. Ad Manage sales tax calculations and exemption compliance without leaving your ERP.

Inside the City limits of Tulsa the Sales tax and Use tax is 8517. Counties and cities can charge an additional local sales tax of up to 65 for a maximum possible. Jul 4 2022 0902 AM CDT.

31 rows Norman OK Sales Tax Rate. State of Oklahoma - 45. Tulsa County in Oklahoma has a tax rate of 487 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa County totaling 037.

Tulsa - Tulsa County - OK Oklahoma - USA 74120. Sales Tax Specialist. You can find more tax rates and allowances for.

2 State Sales tax is 450. Tulsa County - 0367. This is the total of state county and city sales tax rates.

The Oklahoma state sales tax rate is currently. A version of our address database is available for retailersvendors who may want to incorporate this information into their own systems. Sales in the two largest cities Oklahoma City and Tulsa are taxed at total rates between 8 and 9 percent.

Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. How much is tax by the dollar in Tulsa Oklahoma. Theres also a convenience fee of 395 for paying with a Visa Debit card and a convenience fee of 25 for paying with any other type of card.

Search for Default Zip Code Rates. A penny increase in Oklahomas sales tax as proposed to help fund education. There are a total of 470 local.

RemoteWork from Home position. Depending on local municipalities the total tax rate can be as high as 115. State of Oklahoma 45.

The state sales tax is 45 cents per dollar. The current total local sales tax rate in Oklahoma City OK is 8625. Sales Tax and Use Tax Rate of Zip Code 74116 is located in Tulsa City Rogers County Oklahoma State.

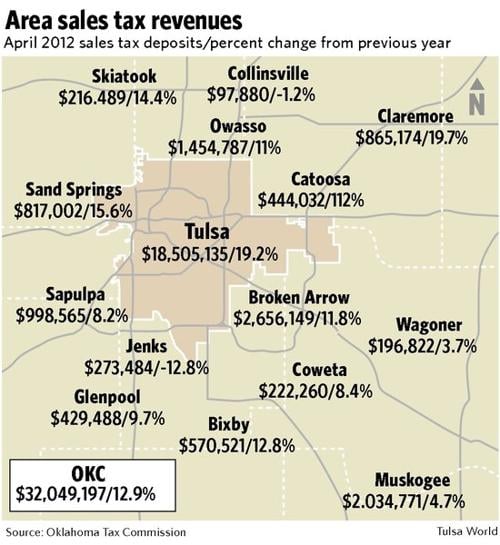

It costs 20 to apply for an Oklahoma sales tax permit. The City of Tulsas July sales tax check which covers the period from mid-May to mid-June as reported by the Oklahoma Tax Commission totaled 19434105 showing a 23 percent. Average Sales Tax With Local.

There is no applicable special tax. The Tulsa Oklahoma sales tax is 852 consisting of 450 Oklahoma state sales tax and 402 Tulsa local sales taxesThe local sales tax consists of a 037 county sales tax and a 365 city sales tax. OnlineRemote - Candidates ideally in.

Search By Zip Code 4. Oklahoma for sale on Zillow Read Less by. Avalara provides supported pre-built integration.

Tulsa in Oklahoma has a tax rate of 852 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa totaling 402. The Tulsa County Oklahoma sales tax is 487 consisting of 450 Oklahoma state sales tax and 037 Tulsa County local sales taxesThe local sales tax consists of a 037 county sales tax.

The Fiscally Responsible Way To Reduce Taxes On Groceries Oklahoma Policy Institute

How Oklahoma Taxes Compare Oklahoma Policy Institute

The Tulsa County Oklahoma Local Sales Tax Rate Is A Minimum Of 4 867

State And Local Tax Distribution Oklahoma Policy Institute

Ok Sales Tax Rebate Tulsa City Fill Out Tax Template Online Us Legal Forms

Total Sales Tax Per Dollar By City Oklahoma Watch

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Oklahoma S Tax Mix Oklahoma Policy Institute

City Sales Tax Revenue Up 19 Percent For Month Politics Tulsaworld Com

Sales Tax Exemption Letter For Oklahoma State Gov T Entities

Taxes Broken Arrow Ok Economic Development

3 Best Tax Services In Tulsa Ok Expert Recommendations

Total Sales Tax By City Oklahoma Watch

Oklahoma Sales Tax Guide And Calculator 2022 Taxjar

Oklahoma Lawmakers Discuss Eliminating State Sales Tax On Groceries